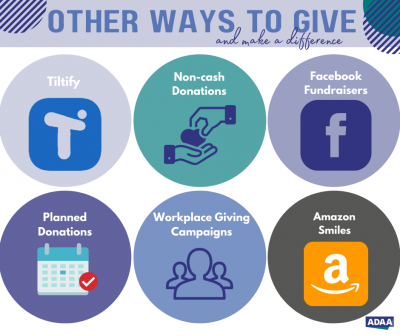

Planned Giving + −

Foundation Contributions

ADAA is a 501(c)(3) and can accept contributions from family, corporate, and private foundations. Contact Susan Gurley, ADAA Executive Director, for more information.

ADAA is a 501(c)3 organization. As no goods or services are provided in return for any charitable contributions, the entire amount of your donation is tax deductible in accordance with IRS regulations. ADAA's Tax ID#: 52-1248820.

Please note that ADAA offers an EFT option with many trusts and funds.

If you have any questions about donating online, please send us an e-mail or call 240-485-1016. To send your gift by U.S. Mail, please make your check payable to ADAA and mail it to ADAA, 8701 Georgia Avenue, Suite 412, Silver Spring, MD 20910. Thank you!

Donor Advised Fund (DAF) + −

A Donor Advised Fund, or DAF, is an organized and easy way for donors to make charitable gifts. A DAF has the potential to help ADAA as we focus on research and treatments for anxiety disorders and depression.

During your lifetime you can recommend a grant from your Donor Advised Fund to impact the lives of those struggling with these disorders. Think of it as your personal charitable checkbook.

3 Easy Ways Steps

- Open your DAF with a financial institution like Fidelity or Schwab

- Contribute to the DAF and get an immediate tax refund

- Recommend grants to your favorite organizations - like ADAA

You can make a gift at any time and receive an immediate tax benefit. Your gift is invested and grows tax-free. ADAA offers an EFT option with many DAFs and trusts.

Interested in learning more? Please contact [email protected]

Non-Cash Ways to Donate + −

You can donate more than just cash. Donating cash is always easy, whether by check, bank wire or Electronic Funds Transfer. And when you donate cash, you can generally deduct up to 50% of your adjusted gross income. But cash isn't the only thing you can use to support ADAA. You can also donate a variety of other assets, including:

- Mutual fund shares

- Publicly traded stocks, including long-term appreciated securities

- Wills and Living Trusts – secure a charitable estate-tax deduction for the value of the gift, and know that your generosity will support our mission for years to come.

- Retirement Plans – your retirement-plan benefits are likely a significant portion of your net worth, and because of special tax considerations, they could make an excellent choice for funding a charitable gift.

- Life insurance policies - life insurance itself can be the direct funding medium for a gift, permitting the donor to make a substantial gift (face value of policy) for a relatively modest annual outlay (i.e., the premium payment).

- Publicly traded bonds

- Appreciated Securities – gifts of long-term appreciated property can generate the most favorable tax benefits: a charitable deduction (in most cases) for the full fair-market value of the property plus avoidance of any potential capital-gain tax.

- Non-publicly traded assets, including private or restricted company stock and real estate

To speak to ADAA about non-cash ways to give please call 240-485-1016 or email [email protected]

Facebook Fundraisers + −

Start your own Facebook Fundraiser here today

Memorials and Dedications

Honor a loved one by donating in their memory or honor. Help build onto their legacy by offering a gift in their name.

Tiltify + −

If you love gaming, then rally your friends together virtually or in-person, or play by yourself, for a cause. Tiltify allows people in the gaming world to “play for fund” – your friends and family can donate to support our mission.

Wedding Registry + −

Make the most of your celebration by dedicating your special day to support ADAA's mission. Add ADAA to your wedding registry as a wonderful gift option for your friends and family to celebrate your special day. You can provide this donate online option or create your own personal fundraiser. Have a question? Email [email protected]

Workplace Giving Campaigns + −

Employer matching gifts is a great way to add value to what your employees do. Virtual or together, you and your employees can create a meaningful fundraiser. Select ADAA to receive matching gifts from your employer, the United Way, America's Best Charities, or the Combined Federal Campaign (CFC); ADAA charity code: 11220. ADAA's tax ID number is 52-1248820

For more information about donation options, please email [email protected] or call 240-485-1016 (please note that you will need to leave a voicemail message).